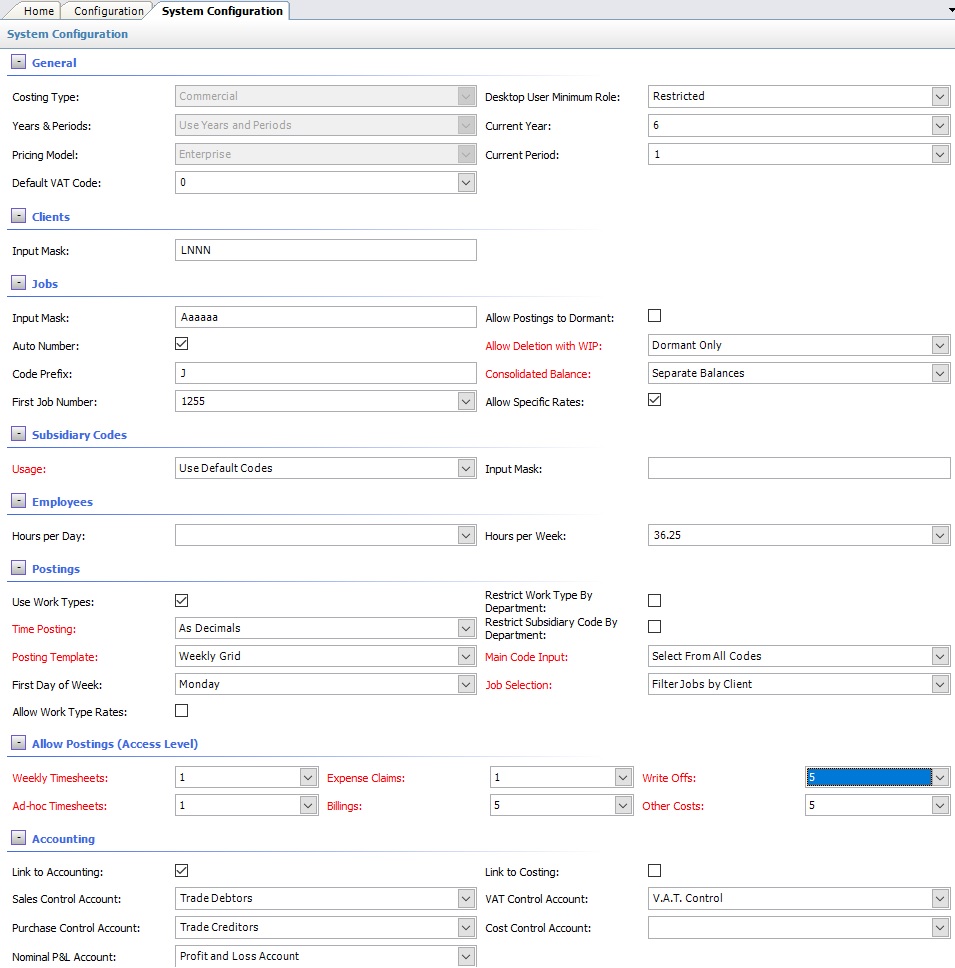

The above program is loaded when the System Configuration row is double clicked from the Configuration view (Example of Commercial costing type).

Please refer to the Data Forms for how to use the System Configuration data form.

Depending on the exact configuration of the system, the following data fields may be available for input / editing:

General

•Costing Type - this was setup when the company was first created and cannot subsequently be amended as it determines the way in which data is stored within the program

•Years & Periods - this is used to analyse billings into separate years and periods. Budget data can be entered into the program so that each Client / Job can be monitored as to the performance against budget. If Ignore Years and Periods is selected, no Periods tab will be shown on each Client / Job view.

•Pricing Model - Version type in use.

•Default VAT Code - If accounting enabled then this will be the default VAT code used when invoicing, otherwise this will be the default VAT % used when invoicing (eg 20).

•Desktop User Minimum Role - Determines a Minimum access level required to use the desktop version. Any Users below this version can only access TallyPro using the Browser or phone/tablet Apps.

•Current Year - the current year (only relevant if Years & Periods are enabled)

•Current Period - the current period (only relevant if Years & Periods are enabled)

Clients

•Input Mask - this setting can be used to define the format for Client Codes. Client Codes can be from 1 to 15 characters in length and are always forced to upper case. If a set format is required, for example a minimum or maximum length or a defined combination of alpha and numeric characters, then the Input Mask can be set to force this format - see Input Masks

•Allow Postings to Dormant (Professional Costing Type only) - determines whether postings can be made to clients that are marked as dormant.

•Allow Deletion (Status Change) with WIP (Professional Costing Type only) - determines whether the status of the client can be changed if there is a positive work in progress value. Options are:

•Never - write offs must be posted to at least the value of the work in progress before the status can be changed to either dormant or deleted

•Dormant Only - the status can be changed to dormant with a positive work in progress value but write offs must be posted to at least the value of the work in progress before the status can be changed to deleted

•Deleted Only - the status can be changed to deleted with a positive work in progress value but write offs must be posted to at least the value of the work in progress before the status can be changed to dormant

•Dormant or Deleted - the status can be changed to either with a positive work in progress value

•Consolidated Balance - determines how the consolidation of postings will be performed as follows (see Consolidate Costs for an example of these options):

•Net Balance - the charge and billing values will be shown as one net charge balance

•Separate Balances - the charge and billing values will be shown separately

•Allow Specific Rates - determines whether specific charge rates (per client per employee) can be set up that will override the default charge rates

Matters (Professional Costing Type only):

•Usage - Matters only apply to the Professional costing type - the Commercial type uses Subsidiary Codings. Matters are used to further define postings (e.g. time sheets) entered against each Client. The Configuration program defines three modes of operation with regard to Matters:

•Do Not Use - for very simple time recording where all postings are to referenced only to the client and no further analysis is required.

•Use Default Codes - for use where matters tend to fall into a number of regular categories - for example a firm of accountants may only wish to subdivide postings between Audit, Accountancy, Taxation, Statutory and Other. This option allows the creation of default matters which can be used whilst postings are being entered.

•Use Work Types - Work Types are used to analyse the type of work that an employee performs. However they can also be used as an alternative to Default Matters where the further analysis of client postings is the same as the types of work being performed.

•Use Specific Codes - this allows specific matters to be created for each client that will be available in addition to the default codes. This can be useful where special work is being undertaken for that client.

•Input Mask - this setting can be used to define the format for Matter codes. Matter codes can be from 1 to 3 characters in length and are always forced to upper case. If a set format is required, for example a minimum or maximum length or a defined combination of alpha and numeric characters, then the Input Mask can be set to force this format - see Input Masks

•Record Agreed Fees - Can be used to record budget data per Matter

Jobs

•Input Mask - this setting can be used to define the format for Job Codes or Job Numbers. Job Codes can be from 1 to 15 characters in length and are always forced to upper case. If a set format is required, for example a minimum or maximum length or a defined combination of alpha and numeric characters, then the Input Mask can be set to force this format - see Input Masks

•Auto Number - this option should be checked if the program is required to maintain a job number sequence, i.e. increment the last job number for each new job created.

•Code Prefix - used in conjunction with the Auto Number setting above, an additional Prefix can be specified so that all job numbers automatically generated start with a given letter or letters.

•First Job Number - this is only used if the Auto Number option is set to on and there are no jobs already created in which case it will determine the first job number to be allocated. Once a single job has been created, this will not be used again.

•Allow Postings to Dormant - determines whether postings can be made to jobs that are marked as dormant.

•Allow Deletion (Status Change) with WIP - determines whether the status of the job can be changed if there is a positive work in progress value. Options are:

•Never - write offs must be posted to at least the value of the work in progress before the status can be changed to either dormant or deleted

•Dormant Only - the status can be changed to dormant with a positive work in progress value but write offs must be posted to at least the value of the work in progress before the status can be changed to deleted

•Deleted Only - the status can be changed to deleted with a positive work in progress value but write offs must be posted to at least the value of the work in progress before the status can be changed to dormant

•Dormant or Deleted - the status can be changed to either with a positive work in progress value

•Consolidated Balance - determines how the consolidation of postings will be performed as follows (see Consolidate Costs for an example of these options):

•Net Balance - the charge and billing values will be shown as one net charge balance

•Separate Balances - the charge and billing values will be shown separately

•Allow Specific Rates - determines whether specific charge rates (per job per employee) can be set up that will override the default charge rates

Subsidiary Codes (Commercial Costing Type only):

•Usage - Subsidiary Codings only apply to the Commercial costing type - the Professional type uses Matters. Subsidiary Codings are used to further define postings (e.g. time sheets) entered against each Job. The Configuration program defines three modes of operation with regard to Subsidiary Codings:

•Do Not Use - for very simple costing where all postings are to referenced only to the job code and no further analysis is required.

•Use Default Codes - for use where Subsidiary Codings tend to fall into a number of regular categories - for example a construction company may only wish to subdivide postings between Labour, Materials and Sub-Contract work. This option allows the creation of default Subsidiary Codings which can be used whilst postings are being entered.

•Use Work Types - Work Types are used to analyse the type of work that an employee performs. However they can also be used as an alternative to Default Subsidiary Codings where the further analysis of job postings is the same as the types of work being performed.

•Use Specific Codes - this allows specific subsidiary codes to be created for each job that will be available in addition to the default codes. This can be useful where non-standard work is being undertaken for that job.

•Input Mask - this setting can be used to define the format for Subsidiary Codes. Subsidiary Codes can be from 1 to 3 characters in length and are always forced to upper case. If a set format is required, for example a minimum or maximum length or a defined combination of alpha and numeric characters, then the Input Mask can be set to force this format - see Input Masks

•Record Agreed Fees - Can be used to record budget data per Subsidiary Code.

Employees

•Hours per Day - this is used for reporting purposes only - e.g. Employee Daily Report

•Hours per Week - this is the default minimum number of hours that each employee MUST post each week. If this is left blank, then no checks will be performed. This value can be overridden for each employee - see Employee Details

Postings

•Use Work Types - Work Types are used to further analyse employees' time spent as specified on their time sheets. Work types can include all possible activities including both chargeable and non-chargeable time (e.g. courses, holidays, sickness). Reports can be generated from this file showing a full 12 month detailed analysis of all employees time spent on different activities.

•Time Posting - time can either be entered as decimals (the most common option) or as hours and minutes. If the 'As Decimals' option is chosen a time sheet posting of 1.50 will be interpreted as 1 1/2 hours and posted in that format. If the 'As Hours And Minutes' option is chosen a time sheet posting of 1.50 will be interpreted 1.83 hours and posted in that format.

•Posting Template - Default Weekly or Daily time entry grid for Employees (Can be overridden in individual Employee record). Weekly is the recommended option.

•First Day of Week - this is currently set as Monday but will be customisable in future versions of the program.

•Allow Work Type Rates - determines whether specific charge rates (per work type) can be set up that will override the default charge rates

•Restrict Work Type by Department - Enable restriction of Work Type to an individual Department.

•Restrict Subsidiary Code by Department - Enable restriction of Subsidiary Code to an individual Department.

•Main Code Input - for the Commercial costing type, determines whether all jobs are available for selection whilst posting or just 'My Jobs'. For the Professional costing type, determines whether all clients are available for selection whilst posting or just 'My Clients'.

•Job Selection - for the Commercial costing type only, determines whether selection is made first by Client and then viewing all jobs for the selected client, or from a list of all jobs (or just 'My Jobs' - see Main Code Input above) with a client verification.

Allow Postings

•Access Level - this determines whether posting options are available, and if so, what minimum user access level is required to post. If the 'Do Not Allow' option is selected, or the user's password level is less than the access level, the posting option will not appear within the Postings navigation pane

Accounting (where enabled)

•Link to Accounting - Enable Accounting integration to TallyPro

•Sales Control Account - Select Nominal Ledger control account for Sales ledger

•Purchase Control Account - Select Nominal Ledger control account for Purchase ledger

•Nominal P&L Account - Select Nominal Ledger control account for Year End Result

•Link to Costing - Allow Accounting entries direct to Clients or Jobs depending on Costing Type.

•VAT Control Account - Select Nominal Ledger control account for VAT ledger

•Cost Control Account - Select Nominal Ledger control account for Cost ledger

NOTE - this data will need to be saved, and an exit made from the program, before any changes made will be activated.

If you require further details on any of the above mentioned options please contact Commercial Software Limited